|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping Goods to Hungary from the USA

Hungary Import Regulations: A Complete Guide for U.S. Shippers

Hungary, a member of the European Union and part of the Schengen Area, offers a straightforward customs process for goods imported from outside the EU. If you're shipping from the USA, understanding Hungary’s import regulations will help you avoid unnecessary delays and expenses.

This guide provides comprehensive information on international shipping to Hungary, including documentation requirements, tax considerations, exemptions, and the benefits of collaborating with an experienced international shipping company. It explains how working with a reputable shipping provider can help reduce international shipping costs and ensure safe, affordable shipping.

Key Facts About Importing to Hungary

Hungary adheres to EU customs laws as a member of the European Union.

Imports from non-EU countries are subject to customs duties, Value-Added Tax (VAT), and, in some cases, excise duties.

- Commercial importers must have an EORI number to interact with EU customs systems.

- Used personal effects may be imported duty-free under certain relocation or returning resident exemptions.

Partnering with a licensed international shipping company can help you ensure full compliance and keep international shipping costs under control.

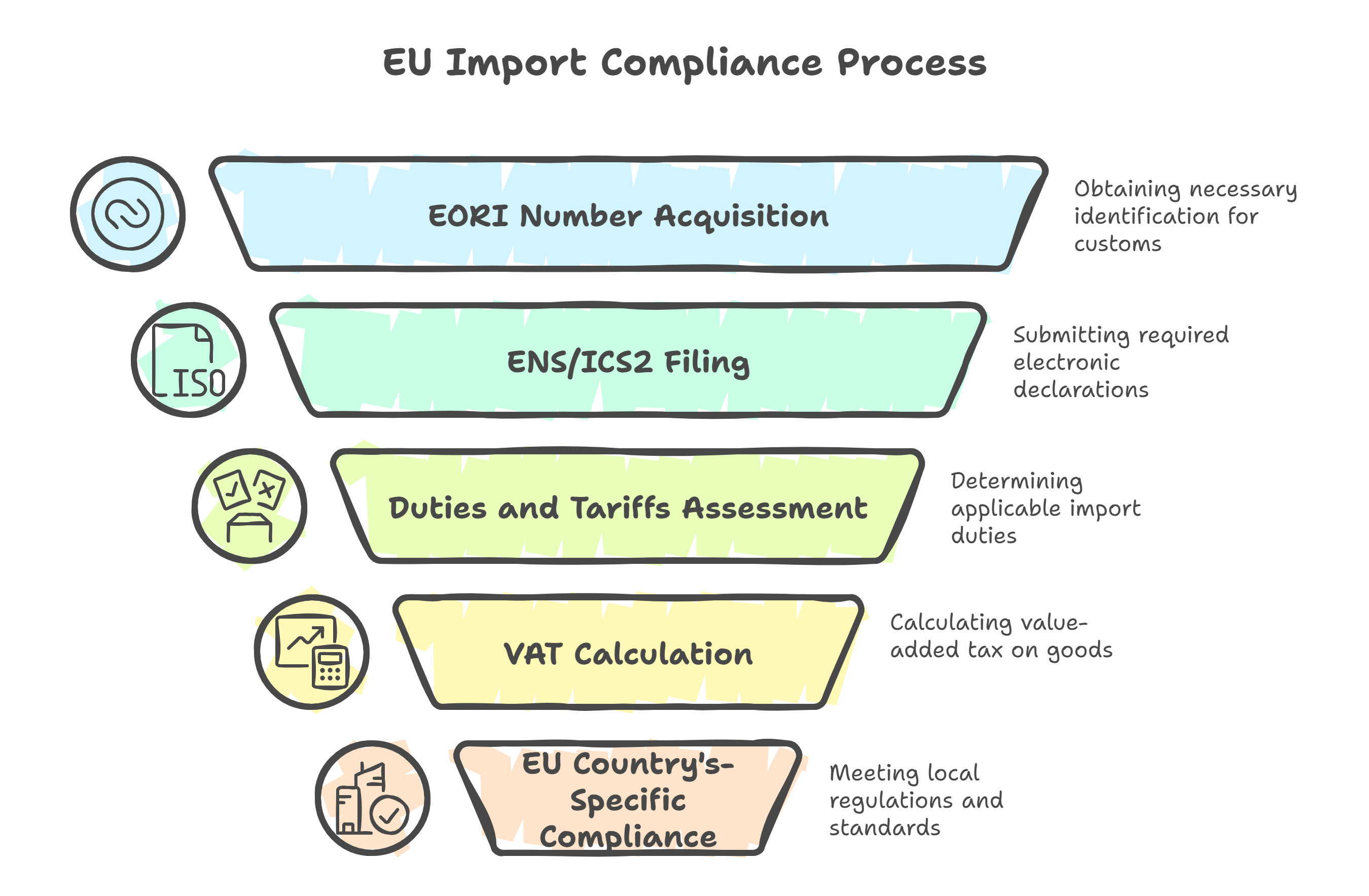

Step-by-Step: How to Import to Hungary

1. Obtain an EORI Number (For Commercial Importers)

- Businesses must register for an EORI (Economic Operators Registration and Identification) number to import goods into the EU.

- Individuals shipping personal goods do not need an EORI number.

2. Required Documents

For customs clearance in Hungary, you'll typically need:

- Bill of Lading (BOL) or Air Waybill

- Commercial invoice detailing items and HS codes

- Packing list

- Certificate of Origin (if using preferential tariffs)

- Single Administrative Document (SAD)

- Import licenses or permits (for restricted goods)

For personal effects:

- Valid passport

- Hungarian visa or residence permit

- Inventory list

- Proof of relocation (residency, employment contract, etc.)

- Declaration of non-commercial use

Ensure consistency across all documents to avoid customs holds.

3. Customs Duties and VAT

If you're shipping from the U.S. to Hungary, be prepared to pay:

- Customs duties: 0–12% based on item classification (via HS codes)

- VAT: Hungary’s standard rate is 27% (applied to CIF value + duty)

- Excise taxes: Applied to alcohol, tobacco, and some luxury goods

Exemptions for Personal Effects

Duty-free import of personal goods is possible if:

- You're relocating and establishing residency in Hungary

- Goods are used for personal use and are ot intended for resale

- Shipment arrives within 12 months of your move

A professional international shipping company can help ensure you meet these conditions and reduce your international shipping costs.

Restricted and Prohibited Goods

Restricted Goods:

- Food and cosmetics – Must meet EU safety and labeling standards

- Electronic items – CE marking required

- Medications and supplements – May require a doctor’s note or permit

- Plants and animal products – Need sanitary/phytosanitary clearance

Prohibited Goods:

- Narcotics and controlled substances

- Counterfeit or pirated goods

- Weapons and certain defense-related materials without authorization

Shipping Personal Effects to Hungary

If you’re relocating, you can import used household goods duty-free. You must:

- Have lived outside the EU for at least 12 months

- By establishing legal residence in Hungary

- Own and use the items for at least 6 months prior to shipping

- Do not sell or dispose of the items for at least 12 months after import

Required Documents:

- Passport

- Residence permit or visa

- Proof of employment or housing

- Detailed inventory list

- Declaration for tax exemption

New or unopened items may still be subject to tax. Used goods must be clearly identified.

Packaging and Labeling Requirements

All retail goods must comply with EU labeling laws:

- Labels must be in Hungarian or include Hungarian instructions

- Metric units must be used

- CE marking is required for electronics, toys, medical devices, and other similar products.

- Food and cosmetics must show expiration/manufacture dates and ingredients

Wood packaging (pallets, crates) must comply with ISPM 15 standards and be heat-treated and stamped accordingly.

Who Can Help?

Work With a Broker or International Shipping Company

A knowledgeable international shipping company or customs broker can:

- File import declarations

- Classify goods under the correct HS codes

- Handle EORI registration (for commercial importers)

- Apply for tax/duty exemptions

- Provide door-to-door delivery in Hungary

This professional guidance ensures smoother entry, reduced international shipping costs, and fully affordable shipping from the U.S.

Final Import Checklist for Hungary

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Business imports | Mandatory for EU customs system |

| SAD (Single Admin. Document) | All shipments | Must be submitted for clearance |

| VAT (27%) | All goods | Charged on value + duty |

| ISPM 15 compliance | Wood packaging | Mandatory for entry |

| Hungarian labeling | Consumer products | Required for local retail |

| Declaration of non-commercial use | Personal effects | Needed for duty exemption |

Conclusion: Shipping to Hungary from the USA

With Hungary’s membership in the EU, importing goods requires attention to customs documentation, tax compliance, and product regulations. Whether you’re relocating or shipping goods for business, preparation is key.

A qualified international shipping company can streamline every step—from document prep to final delivery—helping you reduce international shipping costs and benefit from reliable, affordable shipping from the U.S. to Hungary.

.png)